As interest in solar power grows, many homeowners face a big question: should you buy your panels outright, finance them, or lease them? A solar lease offers a third option, one that can let you access clean energy without a large upfront investment. But like anything that seems easy, it comes with trade-offs. Let’s break down what a solar lease really means, how it works, the benefits and drawbacks, and when it might or might not make sense for you.

For many companies, solar leasing for businesses can provide a cost-effective solution for adopting renewable energy.

What is a solar lease

Think of a solar lease like leasing a car. Rather than buying the car yourself, you pay a monthly fee to use it. With a solar lease, a solar company installs panels on your roof or property, they own and maintain the system, and you pay a fixed monthly rent or fee for the right to use the electricity the system generates.

Under this agreement:

- The solar company keeps ownership of the panels and equipment.

- You get to use the electricity produced, often at a lower rate than your prior utility costs.

- Lease terms typically run 20–25 years.

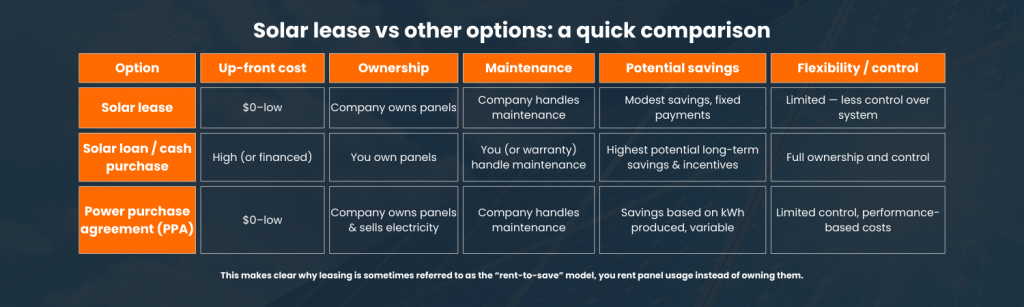

Leasing is part of “third-party ownership,” also used for other solar financing models (like PPAs, or power purchase agreements), where the homeowner does not own the equipment.

Why solar leases appeal to some homeowners

Solar leases have certain advantages that can make them appealing depending on your situation:

minimal or no upfront cost

One of the biggest attractions is that most solar leases come with $0 down, you don’t need to pay for the panels, installation, or equipment upfront. For many people, that removes a major financial barrier.

predictable and potentially lower energy cost

Because you pay a fixed (or nearly fixed) monthly amount, you get predictable energy bills. If the lease payment is lower than what you were paying for electricity from the grid, you start saving money right away.

no maintenance or repair responsibility

Since the solar company owns the system, they are usually responsible for maintenance, repairs, and performance monitoring. That means you don’t have to worry about inverter failures, panel replacements, or upkeep costs.

easier qualifying and cash flow flexibility

Solar leases make solar accessible for homeowners who may not qualify for a loan or prefer not to tie up capital. Because you’re not borrowing money, only leasing equipment, the approval process can be simpler and faster.

immediate access to solar energy

You get the environmental benefits of solar, lower carbon footprint, cleaner energy, without investing much. For many, that’s an easier step than buying, and still better than staying on grid power.

What you sacrifice with a solar lease

But a solar lease is not free sunshine and savings, there are important drawbacks you need to consider.

You don’t own the system, no tax credits or full long-term savings

Because the lease company owns the panels, you are not eligible for federal or state solar incentives, tax credits or rebates that often come with purchasing solar.

That undercuts one of the big financial advantages of buying solar. Over the long term, leasing often yields lower lifetime savings compared to buying with cash or loan.

Monthly payments may rise over time

Many solar lease contracts include an escalator clause, meaning the monthly payment increases each year by a certain percentage (often 1–3% or more). That can cut into or even eliminate savings, especially if utility rates don’t rise at the same pace.

Limited control and flexibility

Since you don’t own the system, you have little control over panel brand, design, maintenance quality, or system upgrades. If you want to expand your system or add battery storage, lease agreements often don’t allow it, or they make it expensive and complicated.

Possible complications when selling or moving

Selling a home with a leased solar system can be tricky. The lease doesn’t automatically transfer to the new owner, they must agree to take it over, or you may need to pay a buyout. That can deter buyers or reduce your sale price.

Lower return on investment over long term

Even though lease payments may be lower initially, because you’re never building equity, you never “own” the savings. Over 20–25 years, you might pay as much, or more, than you would if you bought the system, especially after factoring in escalators and lost incentives.

When solar leases make sense and when they don’t

Solar leasing can make sense when:

- You don’t have the upfront cash or don’t want to take out a loan.

- You want predictable energy payments and minimal hassle.

- You value convenience over maximizing long-term savings.

- You plan to stay in the home for a moderate period, but perhaps not decades.

On the other hand, buying (with cash or loan) might be better if:

- You want to take advantage of tax credits and incentives.

- You plan to stay in the home long-term.

- You prefer to build equity and maximize lifetime savings.

- You want full control over your solar system, upgrades, maintenance, expansions.

What to check carefully before you sign a solar lease

If you decide to explore solar leasing, make sure to:

- Review the contract — Understand monthly payment, length of lease, escalation clause, buyout options, and maintenance responsibilities.

- Ask about performance guarantees — Some companies guarantee a certain power output and refund you if generation drops below that level. That gives you some protection.

- Check transferability — If you sell your home, can the new owner assume the lease? If not, what are your options?

- Compare total cost over 20-25 years — Don’t just focus on monthly payment. Add up all payments, consider escalators, and compare versus buying.

- Ensure company credibility — Because the company owns the equipment and is responsible for maintenance, choose a reputable provider with good reviews and long-term stability.

Final thoughts

Solar leases offer an accessible and relatively hassle-free path to solar energy. For households or organizations that want to avoid upfront costs, skip maintenance headaches, and get started right away, leasing can be an appealing option.

At the same time, the trade-offs are real: lower lifetime savings, less control, and potential complications if you want to sell or upgrade. In many cases, buying or financing the system can deliver better value over a solar system’s lifespan, especially if you plan to stay put for many years.

If you’re considering a solar lease, treat it like any long-term financial agreement. Read the fine print, model long-term costs, compare with owning, and make sure the numbers, not just the marketing, make sense for you.

With careful evaluation, a solar lease can turn high upfront costs into manageable monthly payments and offer a convenient path to cleaner energy. But it’s not a one-size-fits-all solution, whether it’s “right” depends on your budget, goals, and how long you plan to stay in your home.

Sources & further reading

- What is solar leasing? – NerdWallet overview of benefits and risks (NerdWallet)

- Solar leases vs buying: comparative analysis of long-term costs and returns (solarpanelresource.com)

- Solar leasing basics and operational overview: Solar Mason blog (Solar Mason)