As European electricity markets absorbed the combined pressures of tight fossil fuel supplies, elevated carbon prices and rising demand in 2025, solar energy played a critical moderating role in limiting the upward trajectory of power prices, industry analysts and market data suggest. While power prices in some regions rose for the first time since the peak of the 2021–2022 energy crisis, the continued expansion of solar photovoltaic (PV) capacity helped cushion the impact on wholesale and retail markets across the European Union and beyond.

Industry observers say that the dynamics seen in 2025 illustrate the growing influence of solar on market fundamentals: expanding output not only supplies electricity directly, but also displaces more expensive gas-fired generation and reduces exposure to volatile fossil fuel and carbon costs. The result is a uniquely contemporary pattern in which renewables, solar in particular, act as a de-facto price cap on wholesale electricity, even in a year marked by geopolitical uncertainty and transitional policy settings.

Power prices edge higher but solar blunts the impact

European electricity markets, after several years of fluctuation driven by the energy crisis that followed Russia’s partial gas cut-offs in 2021 and 2022, experienced renewed price growth in 2025. According to AleaSoft data, average wholesale power prices in major markets climbed in the first half of the year, reaching levels not seen since mid-2023, as higher gas and carbon allowance prices fed through into market clearing prices. The Nordic market was one of the few exceptions, recording a year-on-year price decrease, but most other regions saw increases ranging from modest to substantial.

Yet, this rise was noticeably less severe than it might have been without the expanded supply of solar and other renewables. Increased PV output in markets such as Spain, France, Italy and Portugal contributed to price declines or price moderation in those countries when compared with earlier periods, even as gas and CO₂ futures climbed. This dynamic is widely interpreted by analysts as evidence of the so-called merit-order effect, a phenomenon in which generation with low marginal costs (like solar) sets a lower clearing price for electricity, displacing higher-cost fossil generation at times of strong renewable output.

In March 2025, for example, solar accounted for more than 10% of the electricity mix across the EU in a single month, marking one of the highest shares ever recorded for solar in that period. This record generation helped push down seasonal wholesale prices and demonstrated the extent to which solar can influence price formation in Europe’s interconnected markets.

Solar’s growing role in the EU power mix

Europe’s solar capacity continued to expand in 2025, albeit against a backdrop of slowing year-on-year growth compared with the rapid expansion seen earlier in the decade. According to SolarPower Europe’s 2025 market outlook, new solar installations across the EU reached approximately 65.1 gigawatts (GW), representing a slight decline from 2024 figures and marking the first annual contraction in new capacity in more than a decade.

Despite this softening in capacity additions, the cumulative effect of nearly 400 GW of total installed PV capacity meant that solar met a significant portion of daytime electricity demand and helped alleviate dependence on fossil fuel generation. In many southern markets, where solar irradiance is high, PV became a material driver of daytime supply, reducing the need for gas-fired peaking and mid-merit generation that typically command higher prices.

The EU as a whole hit its 2025 solar target of around 400 GW of installed capacity, despite mixed growth patterns and regional disparities. SolarPower Europe’s data suggests the bloc reached approximately 402 GW by year-end, reflecting sustained investment and deployment even as residential rooftop segments and corporate power purchase agreement (PPA) markets softened.

Wholesale price trends and PPA dynamics

Solar’s effect on price formation became particularly salient in Corporate PPA markets, where average contract prices for solar energy continued to shrink during 2025. In several European countries, average solar PPA prices dipped below €35/MWh in the third quarter of the year, a notable decline compared with historical norms. Coal and gas generator PPAs remain higher, making solar increasingly competitive for large industrial and commercial buyers.

This downward pressure on PPA prices signals market confidence in solar as a baseload source of predictable, low-marginal-cost electricity, and reflects broader trends of technology cost compression and investor appetite for clean power. At the same time, weaker corporate PPA signings, which fell by 41% between the first and second quarters of 2025, indicate investors remain cautious amid price volatility and lingering regulatory uncertainty.

Price volatility and negative price phenomena

In parts of Europe with especially high solar penetration, the growing share of PV generation has led to more frequent periods of very low or even negative wholesale prices. During the second quarter of 2025, some markets recorded hundreds of hours where supply exceeded demand to such an extent that producers effectively paid to feed electricity into the grid. This phenomenon, a by-product of high solar and wind output coinciding with low demand periods, underscores both the benefits and challenges of integrating large volumes of variable renewables into existing electricity systems.

For producers and developers, negative pricing episodes can erode revenues, prompting increased interest in storage solutions and long-term offtake agreements that offer more predictable returns. Grid operators, meanwhile, have emphasized the need for greater flexibility and demand-side management to better absorb renewable output while maintaining system stability.

Policy context: Decarbonisation targets and market signals

Europe’s experience in 2025 reflects broader energy policy objectives aimed at accelerating decarbonisation while enhancing energy security. Across the Union, national and regional strategies continue to prioritize clean energy deployment, in line with the EU’s RePowerEU framework and 2030 climate and energy targets. These strategies aim to reduce reliance on imported fossil fuels, expand renewable capacity, and foster competitive electricity markets that can withstand global price shocks.

At the same time, market participants acknowledge that hitting long-term climate and price stability goals will require addressing structural constraints. These include permitting delays for new renewable and storage projects, grid bottlenecks that limit cross-border electricity flows, and regulatory frameworks that may not yet fully reflect the operational realities of high-renewable systems.

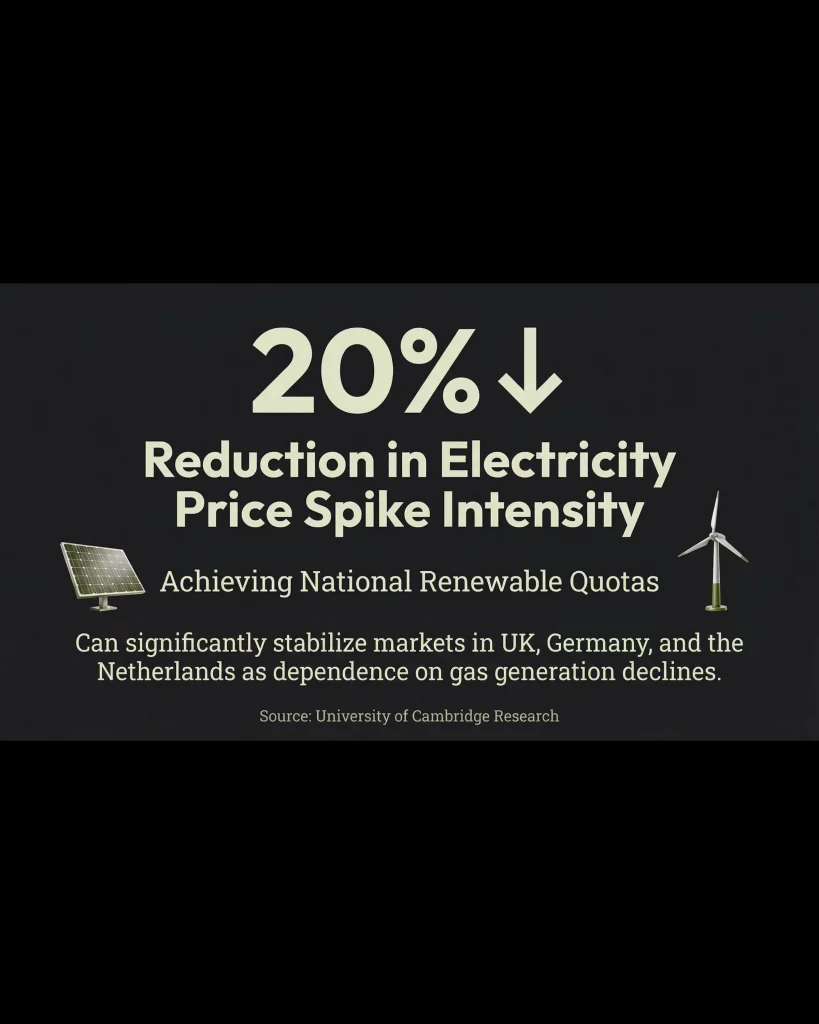

Research from academic and industry sources suggests that, if Europe can meet its 2030 renewable energy deployment targets, particularly for solar and wind, electricity price volatility could fall significantly across multiple markets. For example, a study by University of Cambridge researchers found that hitting national renewable quotas could reduce price spike intensity by as much as 20% in countries such as the UK, Germany, and the Netherlands, as dependence on gas generation declines.

Challenges ahead: Market design and grid flexibility

Despite solar’s moderating influence on price increases in 2025, the continent’s power markets still face several challenges. Wholesale electricity markets were not uniformly favourable; some countries, particularly in northern Europe, saw price rises due to a combination of gas and carbon price pressures and comparatively lower renewable output. Adequate grid infrastructure, including transmission expansion and improved interconnection, remains essential to enable the wider distribution of solar-generated electricity across regions.

Storage deployment, particularly battery systems coupled with PV, is widely seen as crucial for enhancing system flexibility and reducing the incidence of negative prices. Industry analysts argue that storage can help capture excess generation and release it during peak demand periods, smoothing out price fluctuations and improving overall system economics.

Looking forward: The role of solar in stabilising power markets

Solar energy’s expanding footprint across Europe has already contributed materially to capping electricity price growth in 2025, even as traditional cost drivers exert upward pressure on markets. Its role will likely deepen as more PV capacity comes online, storage technology matures, and market reforms better accommodate variable renewable generation.

The narrative emerging from 2025 is less one of unabated price collapse and more one of price resilience, with solar acting as a significant counterweight to the volatility born of fossil fuel markets and geopolitical uncertainties. Policymakers, investors, and grid operators will need to sustain supportive frameworks and strategic infrastructure investments if this resilience is to be maintained and enhanced in the years ahead.

Sources:

- European solar mitigates price increases in 2025 (Table Media) (Table.Briefings)

- AleaSoft analysis of European market prices and solar output (AleaSoft Energy Forecasting); SolarPower Europe data on EU solar installations (Mercomindia.com)

- LevelTen / solar PPA pricing trends (Prometheus Institute); Cambridge renewable price volatility study (Reddit)

- EU solar affordability insights (Energy).