Introduction: a pivotal moment for solar energy

Global Solar Market – Despite staggering growth over the past decade, the global solar photovoltaic (PV) market is entering a period of transition. Market analysts are cautioning that near-term headwinds, from oversupply and pricing pressure to policy uncertainty and trade barriers, are reshaping the competitive landscape. Yet the industry’s long-term fundamentals remain strong, anchored by cost competitiveness, rising demand in emerging markets, and deeper integration of energy storage.

Solar power isn’t just another form of electricity generation. It represents a cornerstone of the renewable energy transition, the shift away from fossil fuels toward cleaner, sustainable sources. Solar PV systems capture energy from sunlight and convert it into electricity using semiconductor materials such as silicon. Its fuel-free nature shields it from fluctuations in oil, gas, and coal prices and makes it resilient against the geopolitical risks that typically affect fossil fuels.

In this report-style exploration, we’ll unpack the current state of the solar market, the pressures it faces, where growth is emerging, and what this means for utilities, investors, policymakers, and everyday energy consumers.

The solar industry at a glance

Before diving into the industry’s current challenges, it helps to understand the scale and structure of the solar market:

- Installed capacity: As of the early 2020s, cumulative global solar PV capacity surpassed 1.6 terawatts (TW), producing thousands of terawatt-hours (TWh) of electricity annually.

- Manufacturing: China dominates global solar manufacturing, responsible for over 80% of module production capacity.

- Market drivers: Falling costs, climate goals, energy security concerns, and electrification of sectors such as transportation and data centers continue to support demand.

With these fundamentals in mind, let’s examine the near-term pressures reshaping the solar industry.

A period of oversupply and price pressure

One of the most persistent challenges facing the solar market today is oversupply. Manufacturing capacity for PV modules, the heart of any solar system, has expanded rapidly, particularly in China and increasingly in Southeast Asia. Analysts estimate that global manufacturing capability already exceeds projected demand for installations, by a significant margin through the mid-2020s.

What causes oversupply?

Oversupply occurs when production capacity outpaces real demand for products, in this case, solar modules and upstream components like polysilicon and wafers. While increased production typically drives innovation and lower costs, too much supply can suppress prices, squeeze margins, and prompt businesses to cut production or exit the industry altogether.

The consequences include:

- Lower prices for modules: Average international module prices have stayed below $0.09 per watt, which is low compared with historical levels.

- Margin pressure: Manufacturers, especially in upstream segments like polysilicon and wafers, find it hard to pass increased input costs downstream. Developers and buyers resist price increases, forcing suppliers to absorb costs.

Raw material pressures

In 2025, materials such as silver, a key raw input in many PV modules, saw noteworthy price increases. Because silver contributes materially to module efficiency and performance, rising costs here can affect overall manufacturing economics.

Balance-of-system costs and levelized cost of electricity

Solar industry economics are often discussed using two important concepts:

Balance-of-system (BOS) costs

BOS costs include everything in a solar project other than the modules themselves: inverters, wiring, mounting hardware, site preparation, permitting, and labor. As module prices have declined significantly over the years, BOS costs now represent a larger share of total system costs.

Levelized cost of electricity (LCOE)

The levelized cost of electricity is a common metric used to compare the long-term cost of power from different generation sources. LCOE accounts for initial investment, operating costs, system lifetime, and energy produced. Falling module prices have reduced LCOE for solar dramatically, in many regions making it the least-cost option for new generation, yet future reductions will rely more on BOS cost improvements than on further reductions in panel prices.

Policy dynamics and trade barriers

Market conditions vary notably by region. Governments play a major role in shaping local solar deployment through policies, incentives, tariffs, and manufacturing requirements.

United States

In the U.S., tariffs and supply chain restrictions have elevated module prices above global averages, roughly $0.27–$0.28 per watt, nearly double international levels. This has slowed deployment and raised project costs. Yet high domestic demand, fueled by data center growth and corporate sustainability commitments, keeps the market strong.

Europe

Europe has faced permitting delays and challenges in grid interconnection, impeding faster solar deployment. When combined with trade disputes and local content rules, these factors have complicated project economics in parts of the continent.

Emerging trade and localization

Policies that encourage local manufacturing, requiring a portion of components to be produced domestically, are reshaping global trade flows. While this can foster local industry growth, it also raises costs if local production lacks economies of scale.

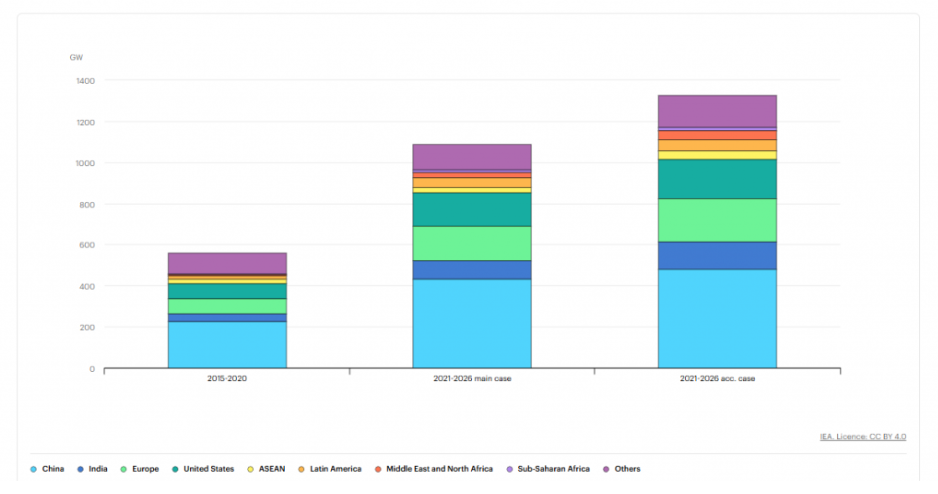

Emerging markets: engines of growth

Despite headwinds in some mature markets, emerging economies are driving much of the solar sector’s momentum.

India

India stands out as a major growth engine. Supported by strong policy backing, rising power demand from industry and households, and ambitious renewable targets, India is projected to add tens of gigawatts of new solar capacity annually through the mid-2020s.

Southeast Asia, Middle East, and Africa

Solar adoption is expanding rapidly in Southeast Asian countries like Indonesia and Vietnam, driven by energy transition plans and energy security goals. In the Middle East, North Africa, and Sub-Saharan Africa, forecasted installations are also on the rise, with growing pipeline projects and increased interest in solar plus storage.

Definition: solar plus storage, pairing solar PV generation with battery storage systems allows renewable energy produced during the day to be used at night or during peak demand hours. This integration enhances grid stability and increases the economic value of solar projects.

Solar plus storage: the new standard

In 2025, more than 23% of large utility-scale solar projects include significant energy storage components, a figure that continues to rise. Energy storage enhances solar’s value by addressing intermittency, the natural variability of solar output between day and night, making solar a more reliable source of dispatchable power.

Battery technology improvements are reducing costs and making integrated systems more attractive. Governments and utilities increasingly view storage not simply as an add-on but as essential for high-penetration solar grids.

Regional divergence and competitive edges

China

China continues to hold a strong cost edge due to scale and concentrated manufacturing infrastructure. The cost to build a fully integrated PV manufacturing chain in Europe or the U.S. remains several times higher than in China, even before subsidies are considered.

However, price pressure has also led to industry consolidation and financial stress for some Chinese manufacturers, illustrating how oversupply affects producers even in dominant markets.

U.S. and advanced markets

In markets like the U.S. and parts of Europe, policy frameworks and tariffs have raised project costs but also incentivized local deployment and manufacturing investments. Technology adoption, grid integration solutions, and smart inverters are advancing rapidly, contributing to broader renewable energy integration.

Near-term projections and future expectations

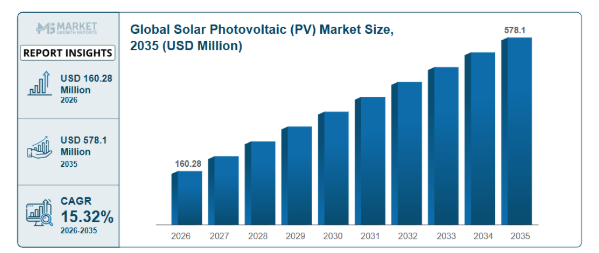

Market forecasts for solar installations show a nuanced picture:

- Some analysts expect the total annual global PV installations to slightly contract in 2026 compared to 2025, marking a rare year-over-year slowdown, due to oversupply and policy headwinds.

- Other projections anticipate continued growth in cumulative capacity and long-term expansion out to 2035, underpinned by falling costs and demand in emerging markets. (Global Growth Insights)

Even if annual growth rates moderate, the larger trend points to steady cumulative expansion of solar capacity worldwide, reinforcing solar’s role in decarbonization efforts.

Conclusion: near-term turbulence, long-term promise

The global solar PV market is navigating a period of significant adjustment. Oversupply, pricing pressures, trade barriers, and policy uncertainty are real challenges that are reshaping business strategies and slowing near-term growth in some regions.

Yet the long-term trajectory remains robust. Solar remains one of the lowest-cost electricity sources globally. Demand is shifting toward integrated solar-plus-storage systems that deliver reliability and flexibility. Emerging markets are emerging as powerful growth engines. Innovative technologies, smarter grids, and evolving financing models are reinforcing solar’s foothold in the future energy mix.

Sources

- TaiyangNews. Global solar market faces pressure but long-term growth intact.

https://taiyangnews.info/business/global-solar-market-faces-pressure-but-long-term-growth-intact - International Energy Agency (IEA). Trends in photovoltaic applications 2024.

https://www.iea.org/reports/trends-in-photovoltaic-applications-2024 - IEA PVPS Programme. Snapshot of global PV markets.

https://iea-pvps.org/snapshot-reports/ - PV Magazine. Solar manufacturing faces structural pressure amid global oversupply.

https://www.pv-magazine.com - Financial Times. Solar industry grapples with oversupply and trade barriers.

https://www.ft.com - BloombergNEF. Global solar market outlook and cost competitiveness analysis.

https://about.bnef.com - International Renewable Energy Agency (IRENA). Renewable power generation costs.

https://www.irena.org - World Bank. Solar energy development and emerging market outlooks.

https://www.worldbank.org - Global Solar Council. Solar market trends and regional growth insights.

https://www.globalsolarcouncil.org - U.S. Energy Information Administration (EIA). Solar electricity generation and capacity data.

https://www.eia.gov