Many homeowners, businesses, schools, or nonprofits exploring solar energy think of buying a solar array outright. But there is another model gaining popularity: the solar power purchase agreement (PPA). Under a solar PPA, you get the benefits of solar electricity without owning the system. Instead, a solar company builds, owns, and maintains the system, and you agree to buy the electricity it produces at a set rate.

This arrangement can make solar more accessible, especially for those who don’t want a large upfront investment or who lack the tax appetite to benefit from solar incentives. But like any long-term agreement, PPAs come with trade-offs. This blog explains how they work, why they can be attractive, where they fall short, and what to assess before committing.

What exactly is a solar PPA

A solar PPA is a long-term contract between a solar services provider (or developer) and you (the home- or facility-owner). The provider installs a photovoltaic (PV) system on your roof or property and maintains it. Instead of paying for the system or financing it, you pay only for the electricity the system produces, typically at a rate lower than your utility’s.

In effect, the solar panels are not yours; the PPA provider retains ownership, and you become a buyer of solar-generated electricity. The contract usually lasts 10 to 25 years, though the exact term depends on the agreement.

Because you don’t own the system, you avoid the substantial upfront cost and the provider assumes responsibility for maintenance, repairs, and performance risk.

Why solar PPAs appeal to many: The main benefits

No upfront cost or financing headaches

One of the biggest draws of a solar PPA is that you typically pay nothing upfront. The provider covers the cost of design, equipment procurement, installation, and ongoing maintenance. For many households or organizations, this lower barrier to entry makes solar accessible even without cash reserves or favorable loan terms.

predictable and often lower energy cost

Under a PPA, you agree to a fixed (or slowly escalating) rate per kilowatt-hour (kWh) for the duration of the contract. That provides stability and protection against rising utility rates.

Because many PPA rates start below typical retail electricity rates, customers often see immediate savings on energy bills, from day one.

no maintenance or technical responsibility

Since the solar provider owns the system, they are responsible for operation, monitoring, maintenance, and repairs. You don’t have to manage component replacements, inverter failures, panel cleaning, or warranty issues.

For many property owners, this “set it and forget it” aspect is a major convenience and risk reducer.

lower financial risk and off-balance-sheet benefit

Because you’re not financing or owning the system, a PPA does not appear as debt on your balance sheet. Instead, it’s treated much like a monthly utility bill. That can make PPAs especially attractive to nonprofits, schools, or businesses that want solar benefits without tying up capital.

environmental benefits and sustainability credentials

Using solar power through a PPA reduces your carbon footprint and demonstrates commitment to clean energy. This can support corporate social responsibility (CSR) goals, improve public image, or help meet renewable energy targets.

Where solar PPAs fall short: The drawbacks and trade-offs

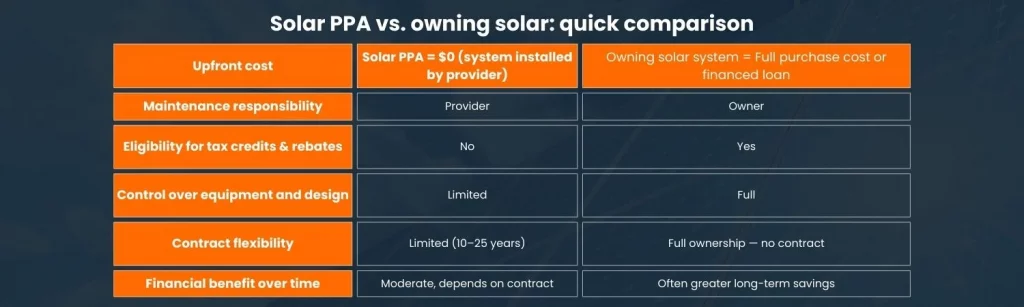

no ownership and no federal tax incentives

Because the solar provider owns the system, you don’t receive the federal or state tax credits, rebates, or other ownership-based incentives. Those benefits go to the owner, the PPA provider.

For homeowners or organizations able to purchase a system directly, those incentives often make ownership far more financially attractive in the long run.

Long-term contract and limited flexibility

Most PPAs come with long-term commitments, often 15, 20, or even 25 years. That level of commitment can be a drawback for people who might move, sell the property, or want to upgrade their solar setup in the near future.

Some PPAs have escalator clauses, meaning the per-kWh price increases modestly over time, which can reduce long-term savings if local utility rates remain stable or fall.

Limited control over equipment and performance

Since the system isn’t yours, you can’t choose panel brands, inverter models, or customize the design. If the provider opts for lower-cost components or delays maintenance, your solar output and savings may suffer.

Also, the energy you pay for depends on how much the system produces. In times of low sunlight (cloudy weather, shading, winter), production drops, and so might your savings.

Possible complications when selling or leasing property

If you plan to sell or lease your home or facility before the PPA term ends, the agreement can complicate the transaction. A buyer or tenant usually must agree to assume the PPA. That requirement can reduce your buyer pool or affect the sale price.

Who benefits most from a solar PPA and who might be better off owning

Solar PPAs tend to work best when:

- You don’t have upfront capital or want to avoid loans.

- You value predictable energy costs and want immediate savings.

- You prefer a hands-off approach: roofing, maintenance, and repairs handled by the provider.

- You run a commercial facility, nonprofit, school, or business property where tax incentives are less useful.

On the other hand, owning your solar system might make more sense when:

- You want to capture all tax credits, rebates, and long-term financial incentives.

- You expect to stay in the property for many years and have a stable energy usage pattern.

- You prioritize maximizing long-term savings and having full control over your solar system.

Many solar experts recommend running the numbers both ways before deciding: compare long-term cost savings, risks, and flexibility depending on your circumstances.

What to look for when evaluating a solar PPA provider

If you are considering a solar PPA, be sure to vet your provider carefully:

- Financial stability: Make sure the company has a solid track record and will remain reliable over a long contract.

- Quality equipment: Even though the system isn’t yours, lower-cost gear can reduce overall performance, affecting your energy production and savings.

- Clear contract terms: Watch for pricing escalation clauses, maintenance responsibilities, system performance guarantees, early-termination costs, and transfer conditions.

- Transferability if you sell: Ensure the contract can be transferred to a new owner or has buyout options if you plan to move.

- Realistic production estimates: Be wary of overly optimistic savings, production depends on local sunlight, shading, weather, and system maintenance.

Final thoughts

A solar power purchase agreement can be a smart and practical way to get solar energy without the burden of upfront investment, maintenance, or system management. For many homeowners, nonprofits, businesses, and schools, PPAs offer a low-risk, hassle-free path to cleaner energy with predictable, often lower electricity costs.

However, PPAs are not ideal for everyone. The trade-offs, lack of ownership, long-term commitment, and limited flexibility, make them less suitable if you want to capture tax benefits, build long-term equity, or aim for maximum savings over decades.

If you consider a solar PPA, treat it like any major financial agreement. Review contract terms carefully, model the long-term cost compared to owning, and choose a provider with a solid reputation, transparent pricing, and reliable performance history.

With careful evaluation, a solar PPA can turn your energy costs from unpredictable burdens into stable, sustainable power, and maybe the decision that brings sunshine to your budget.

Sources

- Solar Power Purchase Agreement (PPA) Explained — how PPAs work and key contract features (NREL)

- Pros and cons of solar PPAs: lower upfront cost, fixed energy rates and maintenance outsourcing, long-term obligations and limited control (The Tech Edvocate)

- What to watch out for when signing a PPA — escalation clauses, system ownership, contract length, and exit costs (roofgideon.com)